40 what is coupon payment of a bond

How to Calculate a Coupon Payment: 7 Steps (with Pictures) - wikiHow To calculate the payment based on the current yield, just multiply the current yield times the amount that you paid for the bond (note, that might not be the same as the bond's face value). For example, if you paid $800 for a bond and its current yield is 10%, your coupon payment is .1 * 800 or $80. [7] 3 Calculate the payment by frequency. What Is Coupon Rate and How Do You Calculate It? Investors use the phrase "coupon rate" for two reasons. First, a bond's interest rate can often be confused for its yield rate, which we'll get to in a moment. The term "coupon rate" specifies the rate of payment relative to a bond's par value. Secondly, a bond coupon is often expressed in a dollar amount. For example, a bank ...

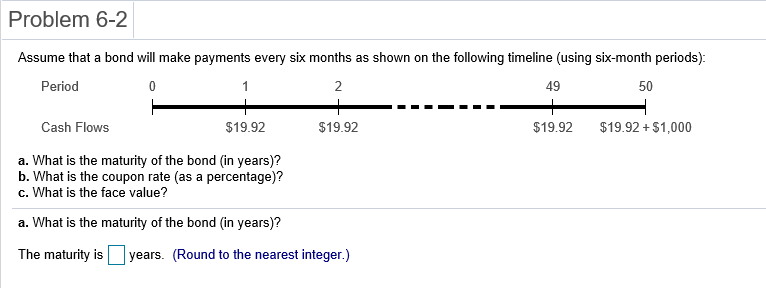

Coupon Bond - Guide, Examples, How Coupon Bonds Work Updated October 13, 2022 What is a Coupon Bond? A coupon bond is a type of bond that includes attached coupons and pays periodic (typically annual or semi-annual) interest payments during its lifetime and its par value at maturity. These bonds come with a coupon rate, which refers to the bond's yield at the date of issuance.

What is coupon payment of a bond

How To Find Coupon Rate Of A Bond On Financial Calculator Enter the bond's coupon payment amount. Divide the coupon payment amount by the face value. Multiply the result by 100 to get the percentage. For example, you have a $1,000 bond with a $50 coupon payment. To calculate the coupon rate, you would divide $50 by $1,000 and multiply by 100. The result is 5%, which means the bond pays 5% interest ... What is a Payment Bond? | Construction Payment Bonds | NFP A payment surety bond is a legal contract, a type of bond, that guarantees certain employees, subcontractors, and suppliers are protected against non-payment. Other common names for these include "construction", and "labor and material". In government contracting, these bonds are sometimes referred to as "Miller Act Bonds". What Is the Coupon Rate of a Bond? - The Balance A coupon rate is the annual amount of interest paid by the bond stated in dollars, divided by the par or face value. For example, a bond that pays $30 in annual interest with a par value of $1,000 would have a coupon rate of 3%.

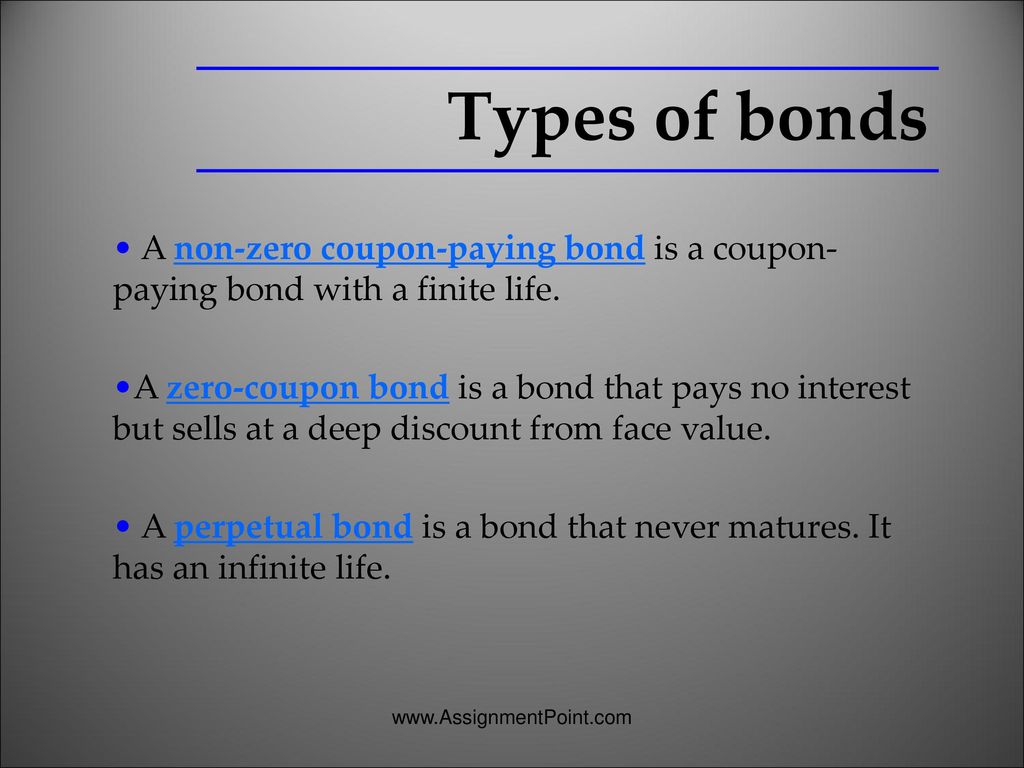

What is coupon payment of a bond. Coupon Definition & Meaning - Merriam-Webster Jul 05, 2012 · The meaning of COUPON is a statement of due interest to be cut from a bearer bond when payable and presented for payment; also : the interest rate of a coupon. How to use coupon in a sentence. Bond Definition & Meaning - Merriam-Webster bond: [verb] to lap (a building material, such as brick) for solidity of construction. Coupon Bond Vs. Zero Coupon Bond: What's the Difference? Aug 31, 2020 · The difference between a regular bond and a zero-coupon bond is the payment of interest, otherwise known as coupons.A regular bond pays interest to bondholders, while a zero-coupon bond does not ... What Is a Bond Coupon, and How Is It Calculated? - Investopedia A coupon or coupon payment is the annual interest rate paid on a bond, expressed as a percentage of the face value and paid from issue date until maturity. Coupons are usually referred to...

What Is a Bond Coupon? - The Balance Mar 04, 2021 · "Bond coupons" is a term that's used to refer to physical coupons. These coupons could be redeemed for cash. The term is another way of referring to a bond's interest payment in 2022 and when it will be due. The bond coupon may not match the actual interest payments on the secondary market. Ups and downs in bond price will change the interest ... Coupon Payment | Definition, Formula, Calculator & Example A coupon payment is the amount of interest which a bond issuer pays to a bondholder at each payment date. Bond indenture governs the manner in which coupon payments are calculated. Bonds may have fixed coupon payments, variable coupon payments, deferred coupon payments and accelerated coupon payments. Coupon Payment | Investor.gov Coupon Payment The dollar amount of interest paid to an investor. The amount is calculated by multiplying the interest of the bond by its face value. Coupon Rate of a Bond (Formula, Definition) - WallStreetMojo Coupon Rate is referred to the stated rate of interest on fixed income securities such as bonds. In other words, it is the rate of interest that the bond issuers pay to the bondholders for their investment. It is the periodic rate of interest paid on the bond's face value to its purchasers.

What is a Coupon Bond? - Definition | Meaning | Example Definition: A coupon bond is a debt instrument that has detachable slips of paper that can be removed from the bond contract itself and brought to a bank or broker for interest payments. These detachable slips of paper are called coupons and represent the interest payments due to the bondholder. Each coupon has its maturity date printed on it. What Is a Coupon Rate? - Investment Firms A coupon rate, also known as coupon payment, is the rate of interest paid by bond issuers on a bond's face value. Generally, a coupon rate is calculated by summing up the total number of coupons paid per year and dividing it by its bond face value. So regardless of what goes on with the market, your coupon rate stays the same. Coupon (finance) - Wikipedia In finance, a coupon is the interest payment received by a bondholder from the date of issuance until the date of maturity of a bond. Coupons are normally described in terms of the "coupon rate", which is calculated by adding the sum of coupons paid per year and dividing it by the bond's face value. For example, if a bond has a face value of ... Zero-coupon bond - Wikipedia A zero coupon bond (also discount bond or deep discount bond) is a bond in which the face value is repaid at the time of maturity. Unlike regular bonds, it does not make periodic interest payments or have so-called coupons, hence the term zero-coupon bond. When the bond reaches maturity, its investor receives its par (or face) value.

What are coupons in treasury bills/bonds? - Quora The "coupon" on a T-note or T-bond is the contractual rate as a percentage of par that will be paid to the holder one-half each time twice a year. A 6% treasury note due November 15, 20xx will pay the holder $30 per $1,000 face value of the note on May and November 15th of each year until the due date. Aaron Brown

Basics Of Bonds - Maturity, Coupons And Yield - InCharge Debt Solutions Current yield is the bond's coupon yield divided by its market price. To calculate the current yield for a bond with a coupon yield of 4.5 percent trading at 103 ($1,030), divide 4.5 by 103 and multiply the total by 100. You get a current yield of 4.37 percent. Say you check the bond's price later and it's trading at 101 ($1,010).

What is a Coupon Payment? - Definition | Meaning | Example Coupon payments are vital incentives to investors who are attracted to lower risk investments. These payments get their name from previous generations of bonds that had a physical, tear off coupon that investors had to physically hand in to the issuer as evidence that they owned the bond.

Treasury Bond (T-Bond) - Overview, Mechanics, Example A Treasury bond (or T-Bond) is a long-term government debt security issued by the U.S. Treasury Department with a fixed rate of return. Maturity periods range from 20 to 30 years. T-bond holders receive semi-annual interest payments (called coupons) from inception until maturity, at which point the face value of the bond is also repaid.

What is the coupon payment of a bond with a face value of $5000 ... - Quora Answer (1 of 3): The concept of interest in connection with a bond is at best ambiguous, but more strictly, meaningless. Interest is the charge for the use of borrowed money. You lend a borrower $5000 and they pay you i% interest for the use of it until they pay it back. A bond issuer, however, u...

What Is a Coupon Payment? - Smart Capital Mind A coupon payment is a payment made to the holder of a bond for the interest that bond accrues while it is maturing. This is typically made as a semi-annual payment, so only half of the interest owed on the bond is paid at a time.

Solved What is the coupon payment of a bond with a face | Chegg.com What is the coupon payment of a bond with a face value of $10, 000 and an annual interest rate of 4%? Coupon payment is equahto (Enter your response as an integer.) Coupon payment is equahto (Enter your response as an integer.)

Coupon Rate - Definition - The Economic Times Definition: Coupon rate is the rate of interest paid by bond issuers on the bond's face value. It is the periodic rate of interest paid by bond issuers to ...

Coupon Types - Financial Edge There is a special type of fixed-rate bond called a zero-coupon bond. In this case, there is no interest payment between the issuance of the bond and maturity. So, they "pay" a fixed coupon of 0%. This does not mean that there is no return for bondholders, as zero-coupon bonds are usually sold at a discounted price but repaid at 100% at ...

Coupon Payment Calculator The coupon payment is the interest paid by a bond issuer to a bondholder at each payment period until the bond matures or it is called. The payment schedule can be quarterly, semiannually or annually, depending on the agreed time. When a bond is first issued, the bond's price is its face value.

Zero-Coupon Bond - Wall Street Prep Zero-Coupon Bond – Bondholder Return. The return to the investor of a zero-coupon bond is equal to the difference between the face value of the bond and its purchase price. In exchange for providing the capital in the first place and agreeing not to be paid interest, the purchase price for a zero-coupon is less than its face value.

Coupon Bond: Definition, How They Work, Example, and Use Today A coupon bond, also referred to as a bearer bond or bond coupon, is a debt obligation with coupons attached that represent semiannual interest payments. With coupon bonds, there are...

What is Coupon payment | Capital.com It's the annual interest payment made by the issuer of a bond to the bondholder until it reaches maturity. The coupon payment - or simply coupon is expressed as a percentage of the bond's value at the time it was issued. Where have you heard about coupon payment? The term coupon comes from once popular bearer bond certificates.

Coupon (Bonds) - Explained - The Business Professor, LLC A coupon is the amount an investor receives for each acquired bond depending on the percentage initially associated with it. For instance, a bond with a face value of $5000 at 4% interest yield per annum will pay a coupon of $200 yearly and $100 per coupon payment since it is done semi-annually.

What is an Advance Payment Guarantee? | NFP The advanced payment bonds provide security through guaranteeing that the contracted company will provide the goods or services that they are contracted to provide before complete payment is made. If the entity that is hired to do provide a good or service does not provide that service, the buyer has a money-back guarantee on their investment. ...

Coupon Bond Formula | Examples with Excel Template - EDUCBA Step 2: Next, figure out the rate of annual coupon and based on that calculate the periodic coupon payment of the bond. The coupon payment is the product of the coupon rate and the par value of the bond. It also does not change over the course of the bond tenure. The annual coupon payment is denoted by C and mathematically represented as shown ...

Coupon Bond - Definition, Terminologies, Why Invest? - WallStreetMojo The holder of a coupon bond receives a periodic payment of the stipulated fixed interest rate, which is determined by multiplying the coupon rate by the bond's nominal value and the period factor. For example, if you own a bond with a face value of $1,000 and an annual coupon rate of 5%, your annual interest payment will be $5.

Coupon bond definition — AccountingTools A coupon bond has interest coupons that the bond holder sends to the issuing entity or its paying agent on the dates when interest payments are due. Interest payments are then made to the submitting entity. The interest coupons are normally due on a semi-annual basis. A coupon bond is unregistered, so the issuing entity has an obligation to pay interest and principal to whomever holds the bond.

What Is the Coupon Rate of a Bond? - The Balance A coupon rate is the annual amount of interest paid by the bond stated in dollars, divided by the par or face value. For example, a bond that pays $30 in annual interest with a par value of $1,000 would have a coupon rate of 3%.

What is a Payment Bond? | Construction Payment Bonds | NFP A payment surety bond is a legal contract, a type of bond, that guarantees certain employees, subcontractors, and suppliers are protected against non-payment. Other common names for these include "construction", and "labor and material". In government contracting, these bonds are sometimes referred to as "Miller Act Bonds".

How To Find Coupon Rate Of A Bond On Financial Calculator Enter the bond's coupon payment amount. Divide the coupon payment amount by the face value. Multiply the result by 100 to get the percentage. For example, you have a $1,000 bond with a $50 coupon payment. To calculate the coupon rate, you would divide $50 by $1,000 and multiply by 100. The result is 5%, which means the bond pays 5% interest ...

:max_bytes(150000):strip_icc()/zero-couponbond_final-a6ec3618516a49c9a3654a1c79c9b681.png)

Post a Comment for "40 what is coupon payment of a bond"