45 consider a bond paying a coupon rate of 10 per year semiannually when the market

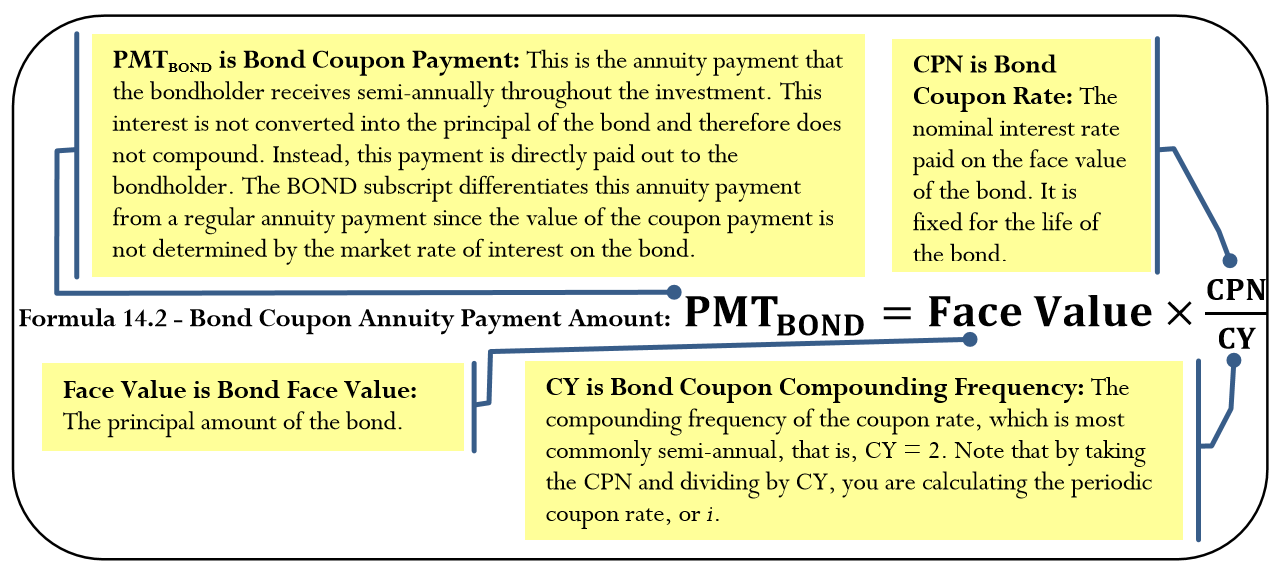

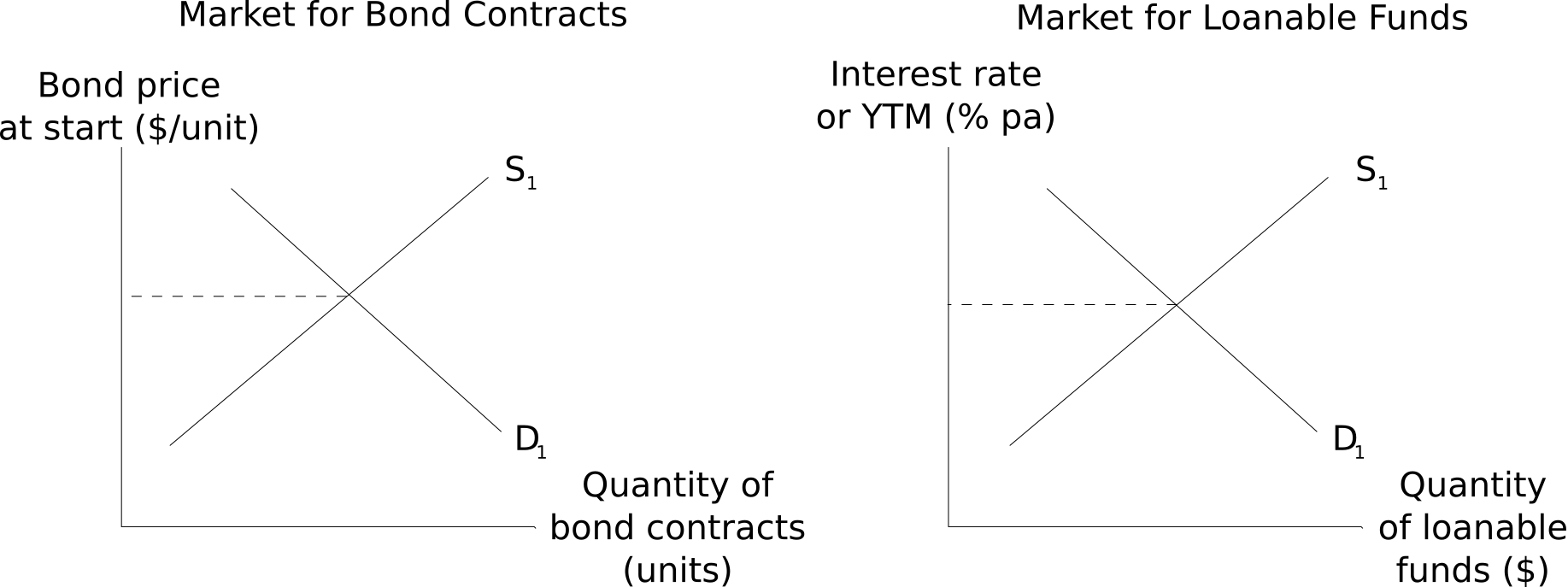

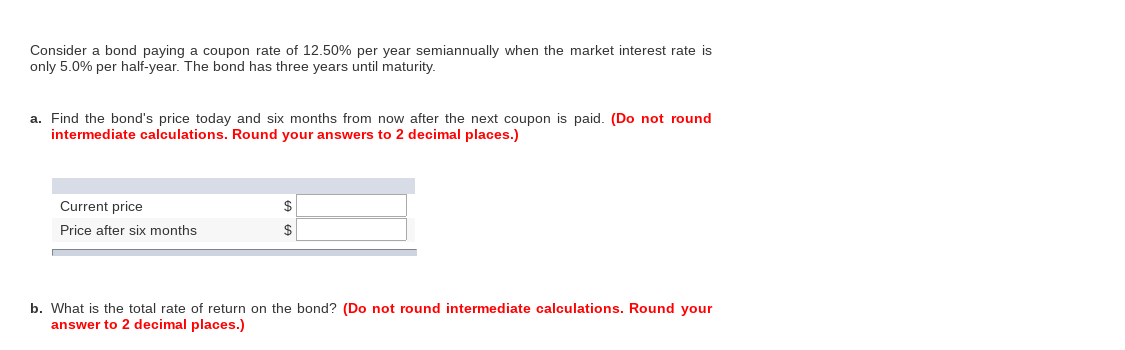

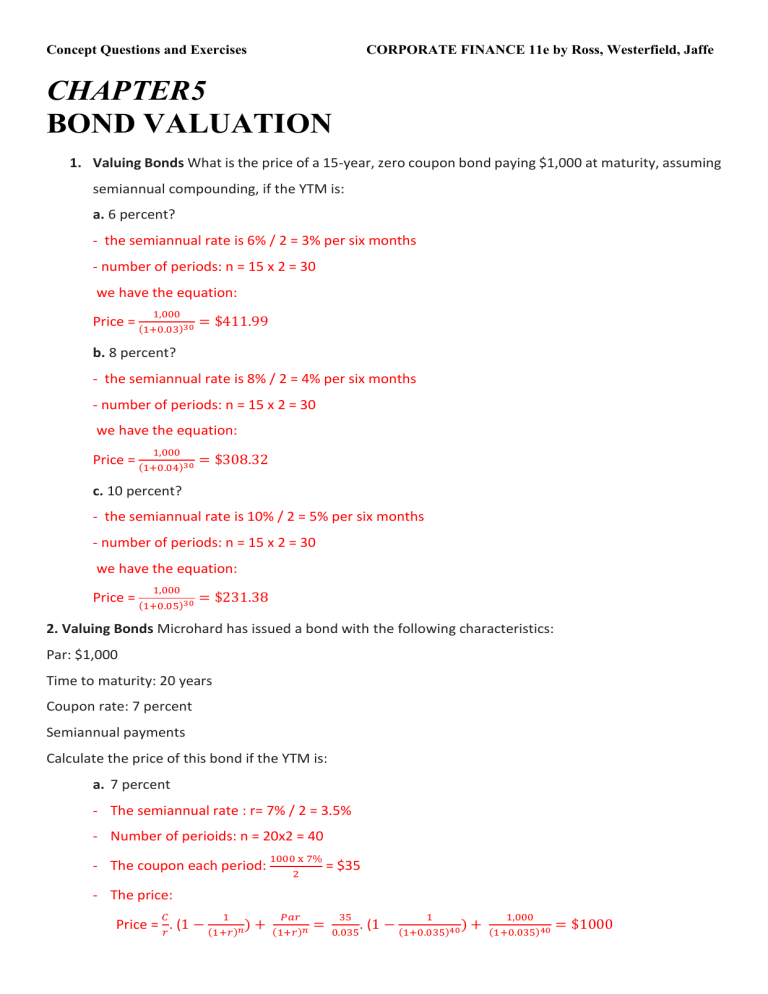

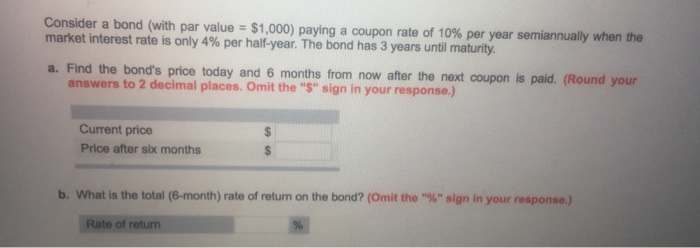

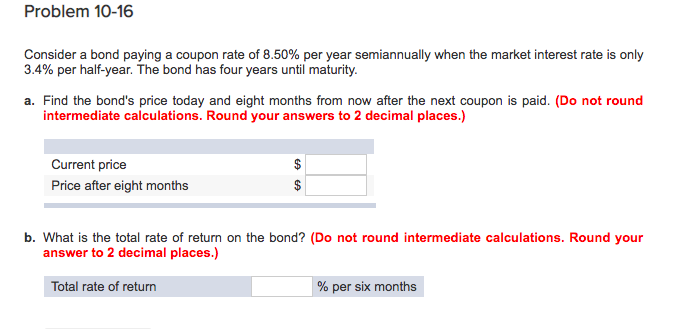

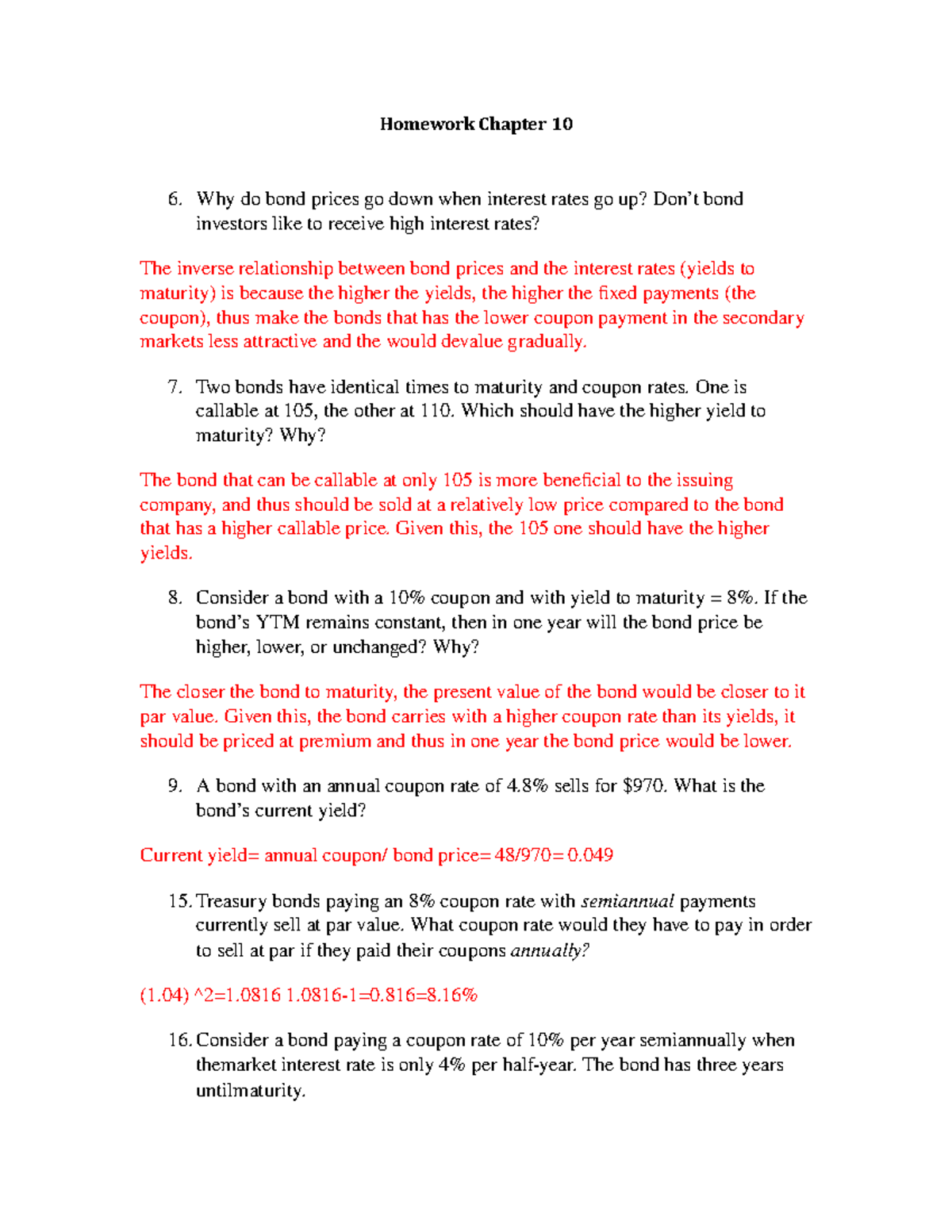

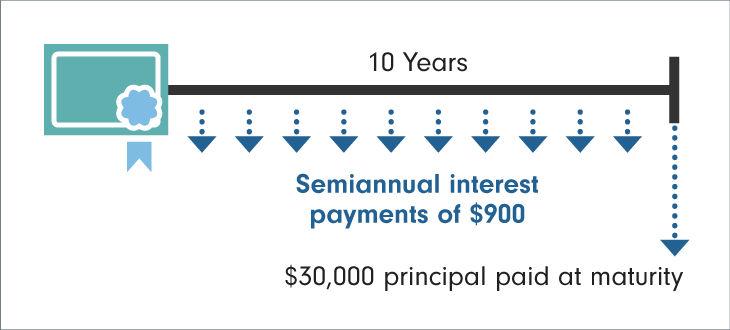

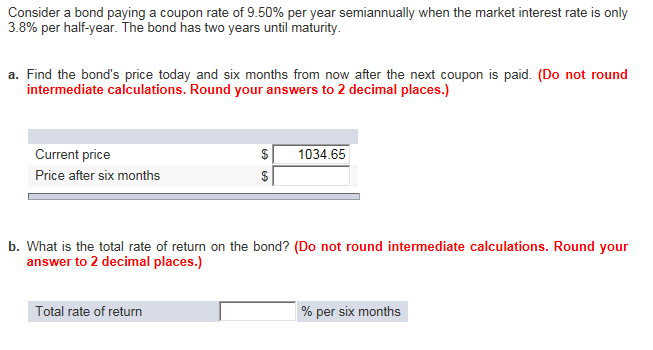

How to Calculate Bond Value: 6 Steps (with Pictures) - wikiHow Apr 19, 2021 · For example, if you require a 5% annual rate of return for a bond paying interest semiannually, k = (5% / 2) = 2.5%. Calculate the number of periods interest is paid over the life of the bond, or variable n. Multiply the number of years until maturity by the number of times per year interest is paid. Practice problems - Consider a bond paying a coupon rate of 10% per ... Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half-year. The bond has three years until maturity. a. Find the bond's price today and six months from now after the next coupon is paid. (Do not round intermediate calculations. Round your answers to 2 decimal places.)

1. Consider a bond paying a coupon rate of 10% per year...get 5 - Quesba Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half-year. The bond has three years until maturity. a) Find the bond's price today and six months from now after the next coupon is paid.

Consider a bond paying a coupon rate of 10 per year semiannually when the market

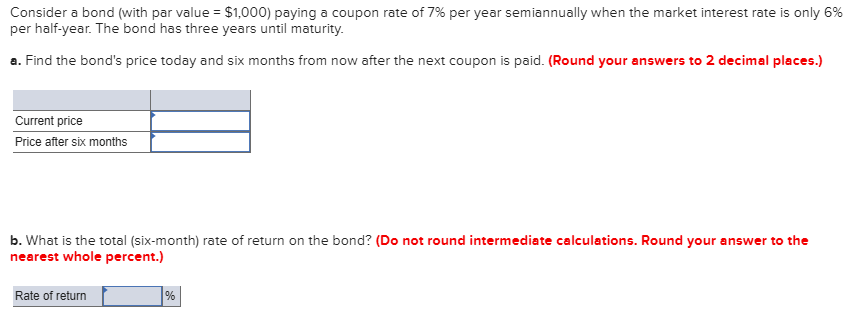

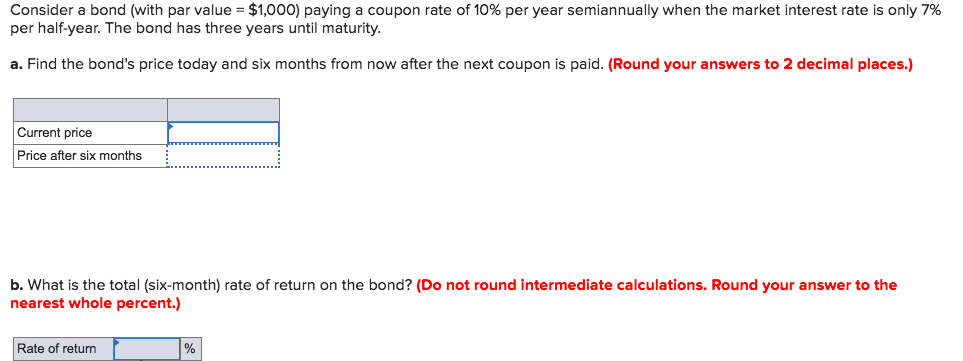

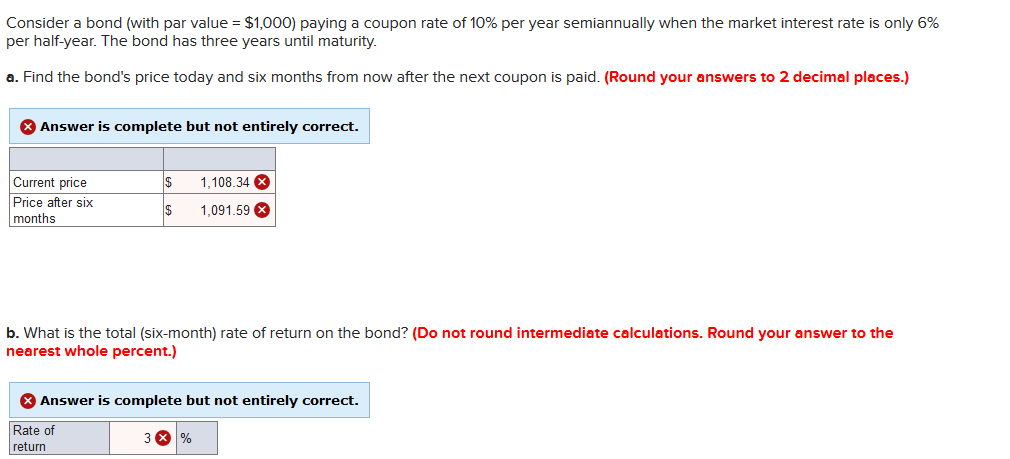

Solved Consider a bond paying a coupon rate of 10% per year - Chegg Finance questions and answers. Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half-year. The bond has three years until maturity. (LO 10 a. Find the bond's price today and six months from now after the next coupon is paid b. What is the total rate of return on the bond? Consider a bond (with par value = $1,000) paying a coupon rate of 10% ... Consider a bond (with par value = $1,000) paying a coupon rate of 10% per year semiannually when the market interest rate is only 7% per half-year. The bond has three years until maturity. a. Find the bond's price today and six months from now after the next coupon is paid. (Round your answers to 2 decimal places.) Macaulay Duration vs. Modified Duration: What's the Difference? Sep 19, 2022 · For example, consider a three-year bond with a maturity value of $1,000 and a coupon rate of 6% paid semi-annually. The bond pays the coupon twice a year and pays the principal on the final payment.

Consider a bond paying a coupon rate of 10 per year semiannually when the market. Answered: Show your work (use of formula, etc.)… | bartleby Business Finance Show your work (use of formula, etc.) in solving the problem: Susan bought a 18-year bond when it was issued by Octodan Corporation 2 years ago (NOTE: the bond was issued 2 years ago. In calculating price today, remember it has only 16 years remaining to maturity). The bond has a $1,000 face value, an annual coupon rate equal to 8 percent and the … Interest - Wikipedia Compound interest includes interest earned on the interest that was previously accumulated. Compare, for example, a bond paying 6 percent semiannually (that is, coupons of 3 percent twice a year) with a certificate of deposit that pays 6 percent interest once a year.The total interest payment is $6 per $100 par value in both cases, but the holder of the semiannual bond receives … Consider a bond paying a coupon rate of 10% per year semiannually when ... Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4%. The bond has 3 years until maturity. a. Find the bond price today and six months from now after the next coupon is paid, assuming the market rate will be constant during the following 6 months. b. Consider a bond paying a coupon rate of 10% per year semiann - Quizlet Question. Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half-year. The bond has three years until maturity. Find the bond's price today and six months from now after the next coupon is paid.

Answered: You obtained a sample of Treasury bill… | bartleby Q: Bare trees united issued 20 year bonds 3 years ago at a coupon rate of 8.5 percent. The bonds make… The bonds make… A: Information Provided: Remaining Bond Maturity = 17 years (20 years - 3 years) Annual Coupon Rate =… Solved Consider a bond paying a coupon rate of 10% per - Chegg This problem has been solved! See the answer. Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half-year. The bond has 3 years until maturity. a. Find the bond's price today and 6 months from now after the next coupon is paid. b. FIN4300 Ch 7 Smartbook Flashcards | Quizlet You are in the 3rd year of a 10-year corporate bond has a 6% coupon, a call premium of $60, and a first call date in year 4. Market interest rates are 5.75% and are expected to drop dramatically for an extended period. If you plan to hold the bond, which yield should you most consider before buying the bond? Consider a bond paying a coupon rate of 10% per year semiannually ... Consider a bond paying a coupon rate of 10% per year semiannually…. Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4%per half-year. The bond has three years until maturity…. Show more Business Share QuestionEmailCopy link This question was created from week2.xlsx Comments (0)

Consider a bond paying a coupon rate of 10% per year semiannually when ... Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half-year. The bond has three years until maturity. a. Find the bond's price today and six months from now after the next coupon is paid. b. What is the total (6-month) rate of return on the bond? Consider a bond paying a coupon rate of 10% per year Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half-year. The bond has 3 years until maturity. a. Find the bond's price today and 6 months from now after the next coupon is paid. b. What is t Join LiveJournal Password requirements: 6 to 30 characters long; ASCII characters only (characters found on a standard US keyboard); must contain at least 4 different symbols; Consider a bond paying a coupon rate of 10% per year Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half-year. The bond has three years until maturity. a. Find the bond's price today and six months from now after the next coupon is paid. b. What is the total rate of return on the bond?

Pro Rata: What It Means and the Formula to Calculate It - Investopedia Jul 18, 2022 · Pro-Rata: Pro rata is the term used to describe a proportionate allocation. It is a method of assigning an amount to a fraction according to its share of the whole. While a pro rata calculation ...

Consider a bond paying a coupon rate of 10% per year semiannually ... Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half year. The bond has three years until maturity. Find the bond's price today and 6 months from now after the next coupon is paid. What is the 6-month holding-period return on this bond?

Compare Income Products - Bonds, CDs, Money Market Funds, … Money market funds aim to protect your principal, but they are not insured and do not come with any guarantee. You can buy or sell shares in a money market fund daily. 0.18%–0.55% in gross expense ratio per year 2: Many funds with $0 minimum investment - otherwise $10,000 to $10 million. Fixed income ETFs

Consider a bond paying a coupon rate of 10% per year...get 5 Answer of Consider a bond paying a coupon rate of 10% per year semiannually when the market-interest rate is only 4% per half a year. The bond has 3 years until...

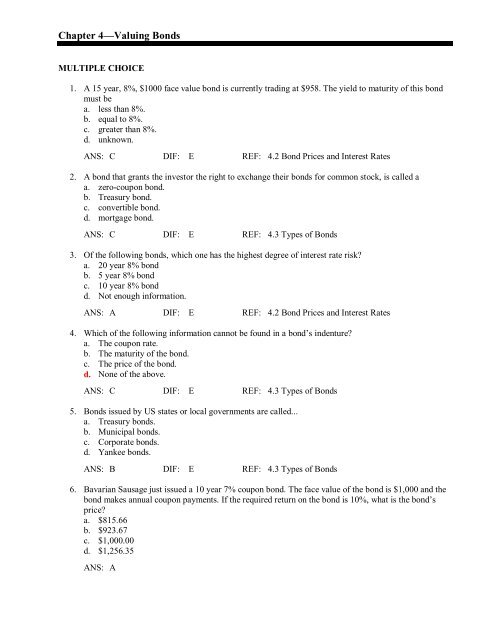

Investments Final Flashcards | Quizlet Study with Quizlet and memorize flashcards containing terms like Bond Price Consider a bond paying a coupon rate of 10% per year semi-annually when the market rate of interest is 8.5% per year. The bond has three years until maturity. Calculate the bond's price today., YTM- Zero Coupon Bond A zero coupon bond has a par value of $1,000, a market price of $150 and 20 years to maturity. Calculate ...

Guide to Fixed Income: Types and How to Invest - Investopedia Aug 31, 2022 · Fixed income is a type of investment in which real return rates or periodic income is received at regular intervals and at reasonably predictable levels. Fixed-income investments can be used to ...

Macaulay Duration vs. Modified Duration: What's the Difference? Sep 19, 2022 · For example, consider a three-year bond with a maturity value of $1,000 and a coupon rate of 6% paid semi-annually. The bond pays the coupon twice a year and pays the principal on the final payment.

Consider a bond (with par value = $1,000) paying a coupon rate of 10% ... Consider a bond (with par value = $1,000) paying a coupon rate of 10% per year semiannually when the market interest rate is only 7% per half-year. The bond has three years until maturity. a. Find the bond's price today and six months from now after the next coupon is paid. (Round your answers to 2 decimal places.)

Solved Consider a bond paying a coupon rate of 10% per year - Chegg Finance questions and answers. Consider a bond paying a coupon rate of 10% per year semiannually when the market interest rate is only 4% per half-year. The bond has three years until maturity. (LO 10 a. Find the bond's price today and six months from now after the next coupon is paid b. What is the total rate of return on the bond?

Post a Comment for "45 consider a bond paying a coupon rate of 10 per year semiannually when the market"