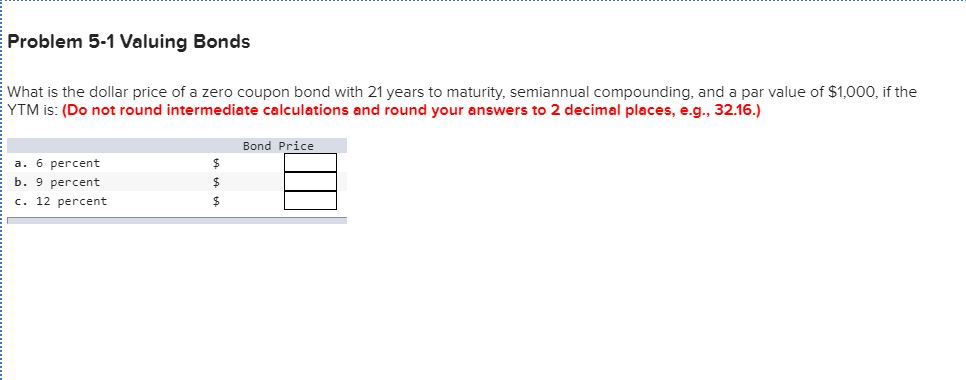

40 valuing zero coupon bonds

Zero Coupon Bonds - Financial Edge Training Value and YTM of Zero Coupon Bonds Bonds are valued by calculating the present value of future cash flows using an appropriate discount rate or interest rate. You can calculate the price of a bond using this formula: Price of Bond = Face value or maturity value/ (1+interest rate) years to maturity Calculating the value of a zero coupon bond Zero-Coupon Bond - Definition, How It Works, Formula John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded annually. What price will John pay for the bond today? Price of bond = $1,000 / (1+0.05) 5 = $783.53 The price that John will pay for the bond today is $783.53. Example 2: Semi-annual Compounding

Zero-Coupon Bond Definition - Investopedia If the debtor accepts this offer, the bond will be sold to the investor at $20,991 / $25,000 = 84% of the face value. Upon maturity, the investor gains $25,000 - $20,991 = $4,009, which translates...

Valuing zero coupon bonds

All the 21 Types of Bonds | General Features and Valuation | eFM 28.4.2022 · Different Types of Bonds Plain Vanilla Bonds. A plain vanilla bond is a bond without unusual features; it is one of the simplest forms of bond with a fixed coupon and a defined maturity and is usually issued and redeemed at face value. It is also known as a straight bond or a bullet bond. Zero-Coupon Bonds. A zero-coupon bond is a type of bond with no coupon … Valuing a zero-coupon bond | Mastering Python for Finance ... Zero-coupon bonds are also called pure discount bonds. A zero-coupon bond can be valued as follows: Here, y is the annually-compounded yield or rate of the bond, and t is the time remaining to the maturity of the bond. Let's take a look at an example of a five-year zero-coupon bond with a face value of $ 100. The yield is 5%, compounded annually. Zero Coupon Bond - WallStreetMojo Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19 Thus the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19.

Valuing zero coupon bonds. Chapter 6 Reading: Bonds (Debt) -- Characteristics and Valuation ... When valuing a semiannual coupon bond, the time period (N) in the present value formula is assumed to have a value of _____ periods. discount, increase, 6-month Natural Gas Producers Inc. (NGPI) has an issue of 7-year, 8% annual coupon bonds outstanding. c) Calculate the Present Value of a zero-coupon bond ... Find the duration of the zero-coupon bond. an. Question: c) Calculate the Present Value of a zero-coupon bond with nominal value 1 million pounds and yield to maturity 6% pa and time to maturity equal to 10 years. Find the duration of the zero-coupon bond. an. Valuing a zero-coupon bond | Mastering Python for Finance Zero-coupon bonds are also called pure discount bonds. A zero-coupon bond can be valued as follows: Here, is the annually compounded yield or rate of the bond, and is the time remaining to the maturity of the bond. Let's take a look at an example of a 5-year zero-coupon bond with a face value of $100. The yield is 5 percent, compounded annually. Zero Coupon Bond: Definition, Formula & Example - Video ... The basic method for calculating a zero coupon bond's price is a simplification of the present value (PV) formula. The formula is price = M / (1 + i )^ n where: M = maturity value or face value. i ...

Zero-Coupon Swap Definition - Investopedia 26.8.2021 · Zero Coupon Swap: A zero coupon swap is an exchange of income streams in which the stream of floating interest-rate payments is made periodically, as it would be in a plain vanilla swap , but the ... Bond valuation and bond yields | P4 Advanced Financial … Since the bonds are all government bonds, let’s assume that they are of the same risk class. Let’s also assume that coupons are payable on an annual basis. Bond A, which is redeemable in a year’s time, has a coupon rate of 7% and is trading at $103. Bond B, which is redeemable in two years, has a coupon rate of 6% and is trading a t $102. Zero Coupon Bond - Investor.gov Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. The maturity dates on zero coupon bonds are usually long-term—many don't mature for ten, fifteen, or more years. Zero Coupon Bond Calculator - What is the Market Value? A zero coupon bond is a bond which doesn't pay any periodic payments. Instead it has only a face value (value at maturity) and a present value (current value). The entire face value of the bond is paid out at maturity. It is also known as a deep discount bond. Benefits and Drawbacks of Zero Coupon Bonds

Understanding Zero Coupon Bonds - Part One - The Balance Zero coupon bonds or zeros don't make regular interest payments like other bonds do. You receive all the interest in one lump sum when the bond matures. You purchase the bond at a deep discount and redeem it a full face value when it matures. The difference is the interest that has accumulated over the years. Zero-Coupon Bond: Formula and Excel Calculator To calculate the price of a zero-coupon bond - i.e. the present value (PV) - the first step is to find the bond's future value (FV), which is most often $1,000. The next step is to add the yield-to-maturity (YTM) to one and then raise it to the power of the number of compounding periods. Zero Coupon Bond Value - Formula (with Calculator) A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value. ACCT 223 | Chapter 7 Flashcards | Quizlet 2. Characteristics of Bonds a. A bond's _____ is generally $1,000 and represents the amount borrowed from the bond's first purchaser. b. A bond issuer is said to be in _____ if it does not pay the interest or the principal in accordance with the terms of the indenture agreement or if it violates one or more of the issue's restrictive covenants.

Zero-Coupon Bond Value | Formula, Example, Analysis ... Zero-Coupon Bond Value Formula Price = \dfrac {M} { (1 + r)^ {n}} Price = (1+r)nM M = maturity value or face value of the bond r = rate of interest required n = number of years to maturity Face Value is equivalent to the bond's future or maturity value. The formula above applies when zero-coupon bonds are compounded annually.

Chapter 7 -- Stocks and Stock Valuation Example: a firm can issue a 10-year 8% coupon bond with a face value of $1,000 to raise money. The firm pays interest semiannually. The net price for each bond is $950. What is the cost of debt before tax? If the firm’s marginal tax rate is 40%, what is the cost of debt after tax? Cost of debt before tax = rd = 8.76%

What Is a Zero-Coupon Bond? | The Motley Fool Zero-coupon bonds compensate for not paying any interest over the life of the bond by being available for far less than face value. Put another way, without a deep discount, zero-coupon bonds ...

How to Calculate a Zero Coupon Bond Price | Double Entry ... The zero coupon bond price is calculated as follows: n = 3 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 7%) 3 Zero coupon bond price = 816.30 (rounded to 816)

Zero coupon bond definition - AccountingTools A zero coupon bond is a bond with no stated interest rate. Investors purchase these bonds at a considerable discount to their face value in order to earn an effective interest rate. An example of a zero coupon bond is a U.S. savings bond.

Zero Coupon Bond Calculator 【Yield & Formula】 - Nerd Counter For instance, the maturity period of a zero-coupon bond is 10-years, its par value is $1000, the interest rate is 5.00%. When we are calculating the bond price in Excel, suppose we use the B column of the excel sheet for entering the values where B2 is the face value, B3 is the maturity time period, B4 is the interest rate.

Reserve Bank of India - Frequently Asked Questions Zero Coupon Bonds – Zero coupon bonds are bonds with no coupon payments. However, like T- Bills, they are issued at a discount and redeemed at face value. The Government of India had issued such securities in 1996. It has not issued zero coupon bonds after that.

Advantages and Risks of Zero Coupon Treasury Bonds General Advantages of Zero-Coupon Bonds Why would anyone want a bond without the interest? Well, for one thing, zero-coupon bonds are bought for a fraction of face value. For example, a $20,000...

Post a Comment for "40 valuing zero coupon bonds"