39 zero coupon convertible bond

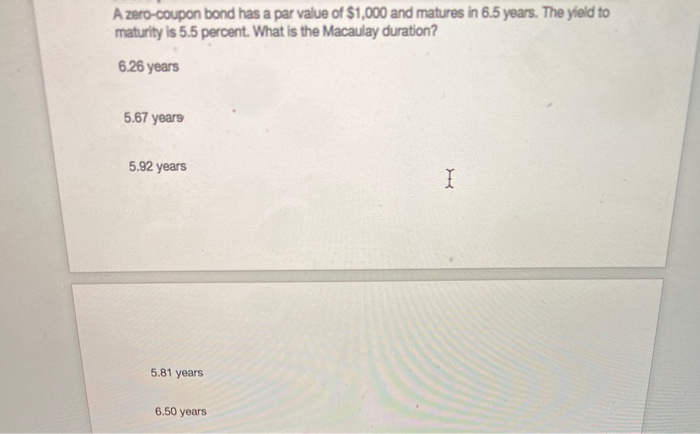

en.wikipedia.org › wiki › Yield_to_maturityYield to maturity - Wikipedia Finally, a one-year zero-coupon bond of $105 and with a yield to maturity of 5.56%, calculates at a price of 105 / 1.0556^1 or 99.47. Coupon-bearing Bonds [ edit ] For bonds with multiple coupons, it is not generally possible to solve for yield in terms of price algebraically. Consol (bond) - Wikipedia History. In 1752 the Chancellor of the Exchequer and Prime Minister Sir Henry Pelham converted all outstanding issues of redeemable government stock into one bond, Consolidated 3.5% Annuities, in order to reduce the coupon (interest rate) paid on the government debt.. In 1757, the annual interest rate on the stock was reduced to 3%, leaving the stock as consolidated 3% …

› terms › cConvertible Bond Definition Oct 06, 2020 · The bond has a maturity of 10 years and a convertible ratio of 100 shares for every convertible bond. If the bond is held until maturity, the investor will be paid $1,000 in principal plus $40 in ...

Zero coupon convertible bond

› dictionary › bondBond Definition & Meaning - Merriam-Webster bond: [verb] to lap (a building material, such as brick) for solidity of construction. Convexity of a Bond | Formula | Duration | Calculation while the duration of the zero-coupon bond Zero-coupon Bond In contrast to a typical coupon-bearing bond, a zero-coupon bond (also known as a Pure Discount Bond or Accrual Bond) is a bond that is issued at a discount to its par value and does not pay periodic interest. In other words, the annual implied interest payment is included into the face value of the bond, which is … corporatefinanceinstitute.com › bondsBonds - Overview, Examples of Government and Corporate Bonds 5. Zero-coupon bond. Zero-coupon bonds make no coupon payments but are issued at a discounted price. 6. Municipal bonds. Bonds issued by local governments or states are called municipal bonds. They come with a greater risk than federal government bonds but offer a higher yield. Examples of Government Bonds. 1.

Zero coupon convertible bond. Glossary | American Century Investments An aggregate index for convertible securities, which includes convertible cash coupon bonds, zero-coupon bonds, preferred convertibles with fixed par amounts, and mandatory equity-linked securities. Bloomberg U.S. Corporate A-Rated Bond Index Consists of publicly issued U.S. corporate and specified foreign debentures that are registered with the Securities and … Zero Coupon Bond Questions and Answers - Study.com Zero Coupon Bond Questions and Answers. Get help with your Zero-coupon bond homework. Access the answers to hundreds of Zero-coupon bond questions that are explained in a way that's easy for you ... › different-kinds-of-bondsTypes Of Bonds: 7 Types Of Financial Bonds For [2022] Oct 28, 2021 · Zero-coupon bonds are one type of bond, while other different types include U.S. Treasuries, agency and municipal bonds, investment-grade and junk bonds, foreign bonds, and convertible bonds. There are government bonds, corporate bonds, and savings bonds. corporatefinanceinstitute.com › bondsBonds - Overview, Examples of Government and Corporate Bonds 5. Zero-coupon bond. Zero-coupon bonds make no coupon payments but are issued at a discounted price. 6. Municipal bonds. Bonds issued by local governments or states are called municipal bonds. They come with a greater risk than federal government bonds but offer a higher yield. Examples of Government Bonds. 1.

Convexity of a Bond | Formula | Duration | Calculation while the duration of the zero-coupon bond Zero-coupon Bond In contrast to a typical coupon-bearing bond, a zero-coupon bond (also known as a Pure Discount Bond or Accrual Bond) is a bond that is issued at a discount to its par value and does not pay periodic interest. In other words, the annual implied interest payment is included into the face value of the bond, which is … › dictionary › bondBond Definition & Meaning - Merriam-Webster bond: [verb] to lap (a building material, such as brick) for solidity of construction.

China Petrochemical raises $132m from CB | barclays, convertible, china petrochemical | FinanceAsia

Haitong makes triumphant return to CBs | haitong international, convertible bond, brokers, fig ...

Post a Comment for "39 zero coupon convertible bond"